The Income of a nation can be denoted by different terms like Gross Domestic Product, National Income, Net National Income, Net Domestic Product etc.

These terms may be used interchangeably in day-to-day

conversations. Yet, they are conceptually different. Therefore, it is

important to know these important concepts:

1. Residents and Non-Residents

The concept of resident is different from citizenship.

Governments classify people as residents and non-residents

A person becomes the resident of a country for

that/one year if:

- The person is residing in that country for a period of 182 days in a given financial year or more. The person is known as ‘ordinarily residing’ in that nation. Such a person may or may not be the citizen of that country.

- The person’s economic interest lies in that country, which means that the person carries out his economic activities (like consumption, production, investment etc) in that nation.

The knowledge of residents and non-residents is

required because we can measure domestic income as well as national income.

2. Domestic Income/Product and National Income/ Product

Domestic income is the income generated within the

domestic territory of the region (it is generated by residents and

non-residents of the country).

National Income is the income generated by only the normal

residents of the country (it may be generated outside the domestic territory).

Before understanding the calculation of domestic and national income, it will be useful to know about the concept of domestic territory

Domestic Territory

In layman sense, domestic territory may mean the geographical boundary or political territory of a nation. But, in economics, we talk about the ‘Economic territory’ of the nation.

According to U.N , domestic territory is the territory administered by the government within which there is a free movement of goods and services, capital and labour. Consider the case of embassies. In case of Foreign embassies situated in India, there is no free movement of our labour, capital and goods and services. Hence, foreign embassies located in India do not fall under the domestic territory of India.

On the other hand, there is free movement of labour, capital and goods and services in Indian embassies located in foreign countries, making it a

part of the domestic territory of India. Thus, economic territory is that area

where our goods, labour and capital enjoy freedom of circulation.

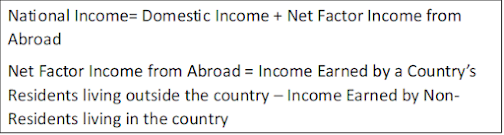

Conversion from Domestic to National income

When GDP is calculated, the value of goods and services or income generated within the domestic boundary of the nation (by residents and non-residents)is included.

After estimating the GDP, the income of residents living outside

India is added and that of non-residents living in India is subtracted, giving us the

net factor income from abroad. This income is added to the GDP to get the

national income from the domestic income.

Another set of terms while explaining national income is gross income and net income. What gives this difference? It is the depreciation or consumption of fixed capital which makes the difference between these two terms.

Subtracting the depreciation from the gross product gives us the net product.

What is Depreciation?

Over time fixed assets like plant, machinery, equipment lose their value due to

- Wear and Tear

- Accidental damages

- Obsolescence

When you buy a good in a market, it says inclusive of all taxes. Which means certain taxes were levied by the government after the good was produced or Taxes may have been added at every stage of production.

This also means when the good was produced initially or more specifically at the factory level, it was devoid of these indirect taxes. Thus, taxes raise the price of a good, and goods are expensive than what they were when produced in the factory.

Similarly, governments given subsidy on certain products. Example, subsidy to farmers for purchasing fertilizers, subsidy to households for installing solar panels. The subsidies reduce the price of the good. As a result of subsidies. goods become cheaper in the market than when they were produced in the factory.

These taxes and subsidies are what differentiates between market prices and at factor cost.

Therefore, Domestic Product at Market prices refers to the product which is calculated at market prices. And, Domestic product at factor cost refers to the product which is calculated at the factory level.

In order to find Domestic or National product at factor cost, taxes are deducted and subsidies are added. And in order to find the Domestic or National Product at Market Price Taxes are added and subsidies are subtracted.

|

Gross

Domestic Product at Market Price (GDPMP) |

·

Includes Depreciation ·

Includes Income of Domestic Territory (residents

and non-residents) ·

Product at Market Prices (Includes Net Indirect

Taxes) |

|

Gross

Domestic Product at Factor Price (GDPFC) |

·

Includes Depreciation ·

Includes Income of Domestic Territory (residents

and non-residents) ·

Product at Factor Prices (Excludes Net Indirect

Taxes) |

|

Net Domestic

Product at Market Price (GDPMP) |

·

Doesn’t Include Depreciation ·

Includes Income of Domestic Territory (residents

and non-residents) ·

Product at Market Prices (Includes Net Indirect

Taxes) |

|

Net Domestic

Product at Factor Price (GDPFC) |

·

Doesn’t Include Depreciation ·

Includes Income of Domestic Territory (residents

and non-residents) ·

Product at Factor Prices (Excludes Net Indirect

Taxes) |

|

Gross National

Product at Market Price (GDPMP) |

·

Includes Depreciation ·

Includes Net Factor Income from abroad Income (income

of only residents is included) ·

Product at Market Prices (Includes Net Indirect

Taxes) |

|

Gross National

Product at Factor Price (GDPFC) |

·

Includes Depreciation ·

Includes Net Factor Income from abroad Income (income

of only residents is included ·

Product at Factor Prices (Excludes Net Indirect

Taxes) |

|

Net National

Product at Market Price (GDPMP) |

·

Doesn’t Include Depreciation ·

Includes Net Factor Income from abroad Income (income

of only residents is included ·

Product at Market Prices (Includes Net Indirect

Taxes) |

|

Net National

Product at Factor Price (GDPFC) |

·

Doesn’t Include Depreciation ·

Includes Net Factor Income from abroad Income (income

of only residents is included ·

Product at Factor Prices (Excludes Net Indirect

Taxes) |